td ameritrade tax rate

TD Ameritrade will report a dividend as. Ad No Hidden Fees or Minimum Trade Requirements.

The Independent Contractor Tax Rate Breaking It Down Benzinga

Get competitive margin rates service fees exception fees and trading tools.

. TD Ameritrade receives compensation for sending its customers cash to TD Bank which is probably why its the default option. TD Ameritrade Secure Log-In for online stock trading and long term investing clients. Subject to change without prior noticePlease call 800-669-3900.

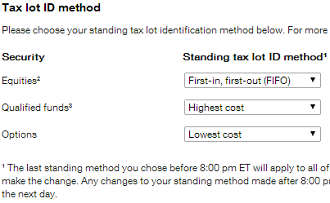

A tax lot is a record. We will assess your choices with you on a case-by-case basis. Holding period requirements that must be met to be eligible for this lower tax rate.

AAM ChnStr Tax Advtg Inc 2022-1 CA TAPAAX ----Symbol lookup. Subject to backup withholding TD Ameritrade will withhold. Before investing carefully consider the funds investment objectives.

Open an Account Now. Gains earned from trading activity are. The tax rate you pay on your investment income depends on how you earn the money.

The calculator assumes the highest tax rate for the state you select. E-Trade has more than 4400 of these funds while TD Ameritrade has more than 3700 but you should be able to find a fund that fits your needs at either broker. TD Ameritrade Cash Sweep Interest Rates.

Fund Inception 09061994. The Plus IDA is a program for TD. 1 All service fees are listed in USD and are subject to change.

Fund Advisor s Vanguard Group Inc. Non-GAAP Diluted EPS 111 1 Average Client Trades per Day of 928000 Pre-tax Margins of 51 percent TD Ameritrade. Not required to file a US.

Check the background of TD Ameritrade on FINRAs BrokerCheck. While TD Ameritrade doesnt charge an inactivity fee it does impose a 75 transfer-out fee though partial transfers are free. Fund Subadvisor s Manager Biography.

Ad No Hidden Fees or Minimum Trade Requirements. Manager Start Date 06282013. TD Ameritrade calculates a blended rate that equals.

You may contact the TD Ameritrade Singapore Trade Desk at 65 6823 2250 to discuss the process. Taxes related to TD Ameritrade offers are your responsibility. Schwab New York Municipal Money Fund - Investor Shares 1 Tax-Free.

Withholding at a rate of 28 on all taxable dividends interest sales proceeds including those from options transactions. Tuesday May 24 2022 93449 AM EDT. TD Ameritrade has worked.

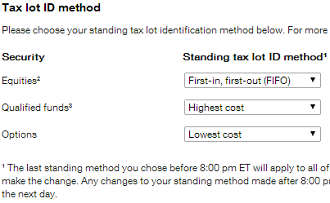

Account 123456789 Detail for. All Promotional items and cash received during the calendar year will be included on your consolidated Form 1099. Each time you purchase a security the new position is a distinct and separate tax lot even if you already owned shares of the same security.

Effective March 17 2020. Where TD Ameritrade could improve Account fees. Foreign exchange at TD Ameritrade also is commission free but trading costs are reflected in the bidask spread.

Manager Name James M. Record Net New Client Assets of 32B GAAP Diluted EPS 107. View the list of money market funds available at TD Ameritrade.

961 000 000. TD Ameritrade FDIC Insured Deposit Account Rates - Plus. TD Ameritrade features straightforward brokerage fees.

Futures commissions at ETRADE are 150 per side plus fees. You are urged to. Pass-through fees charged to TD Ameritrade Singapore will be passed on to the clients account.

TD Ameritrade outbound full account transfer ACAT fee. TD Ameritrade Clearing Inc. Open an Account Now.

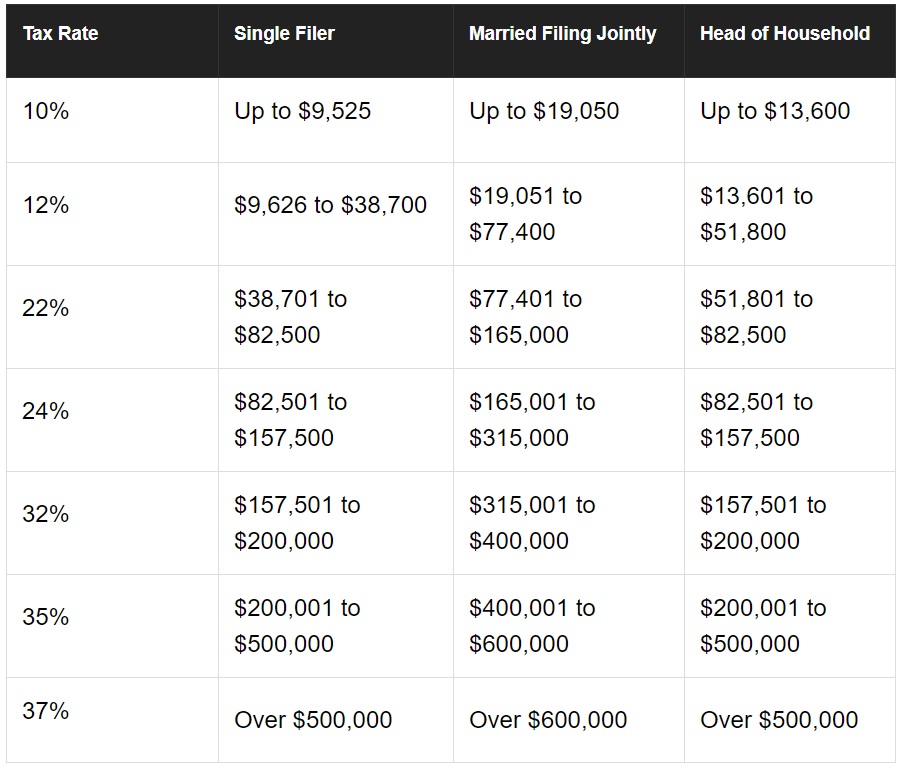

Some states may have lower tax rates within each federal tax bracket depending on the investors income level and type of. TD Ameritrade account inactivity fee. TD Ameritrade outbound partial account transfer fee.

The amount of TD Ameritrades remuneration for these services is based in part on the. Tax exempt funds may.

Planning Ahead How Will Your Estate And Heirs Be Taxed Ticker Tape

Strategies Rules For Capital Gains Tax On Investments Ticker Tape

How To Read Your Brokerage 1099 Tax Form Youtube

Pass Through Business Income And 2018 Tax Reform Doe Ticker Tape

Choose The Right Default Cost Basis Method Novel Investor

What Stock Market History Tells Us About Corporate Tax Hikes In 2021 Stock Market Stock Market History Corporate Tax Rate

What Are Qualified Dividends And Ordinary Dividends Ticker Tape

Td Ameritrade Review 2022 Pros Cons And How It Compares Nerdwallet

What Are Qualified Dividends And Ordinary Dividends Ticker Tape

2020 Tax Brackets And Tax Deductions Silver Linings Ticker Tape

Beginner S Guide To Asset Allocation Actively Managed Vs Index Mutual Funds Real Estate Investment Trust Real Estate Investing Investing

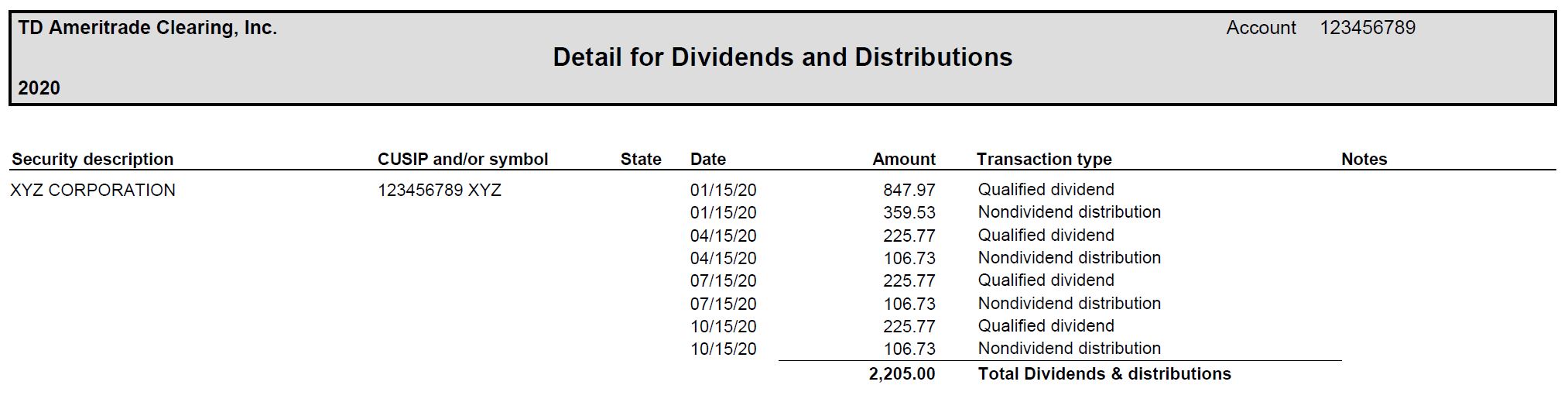

Get Real Time Tax Document Alerts Ticker Tape

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

What Tax Rules Apply To A Non Resident Alien Trading Us Stocks From Outside The Us Quora

/Robinhoodvs.TDAmeritrade-5c61bba946e0fb0001587a6f.png)